mass tax connect payment

Visa or MasterCard debit card. MassTaxConnect gives you the option to pay by EFT debit.

Advance Payment Requirements Mass Gov

If you are not registered for MassTaxConnect but need to make a payment.

. With MassTaxConnect you can. The Massachusetts taxation department has an online service called MassTaxConnect where you can pay taxes. MassTaxConnect is the name of MA DORs online account platform for both individuals and businesses.

Payments with a status of Is in Progress or Completed cannot be deleted. Submit and amend most tax returns. Before making an Income quarterly estimated payment calculate online with the Quarterly Estimated Tax Calculator.

Log in to MassTaxConnect. Visit DOR Personal Income and Fiduciary estimated tax payments for more information. Youll learn how to pay a tax bill or make an extension or estimated tax payment using the Make a Payment feature.

Unfortunately you cannot file taxes through Mass Tax Connect. Set up a payment agreement If you owe 5000 or less Request a Certificate of Good Standing andor Corporate. MyconneCT is the new Connecticut Department of Revenue Services DRS online portal to file tax returns make payments and view your filing history.

Call 617 887-6367 for information on the payment agreement up to 5000 and 617 887-6400 for 5001 or more. Individual taxpayers can make bill estimated extension or return payments on MassTaxConnect without logging in. Complete the information on the next page personal information bank information payment amounts and due dates.

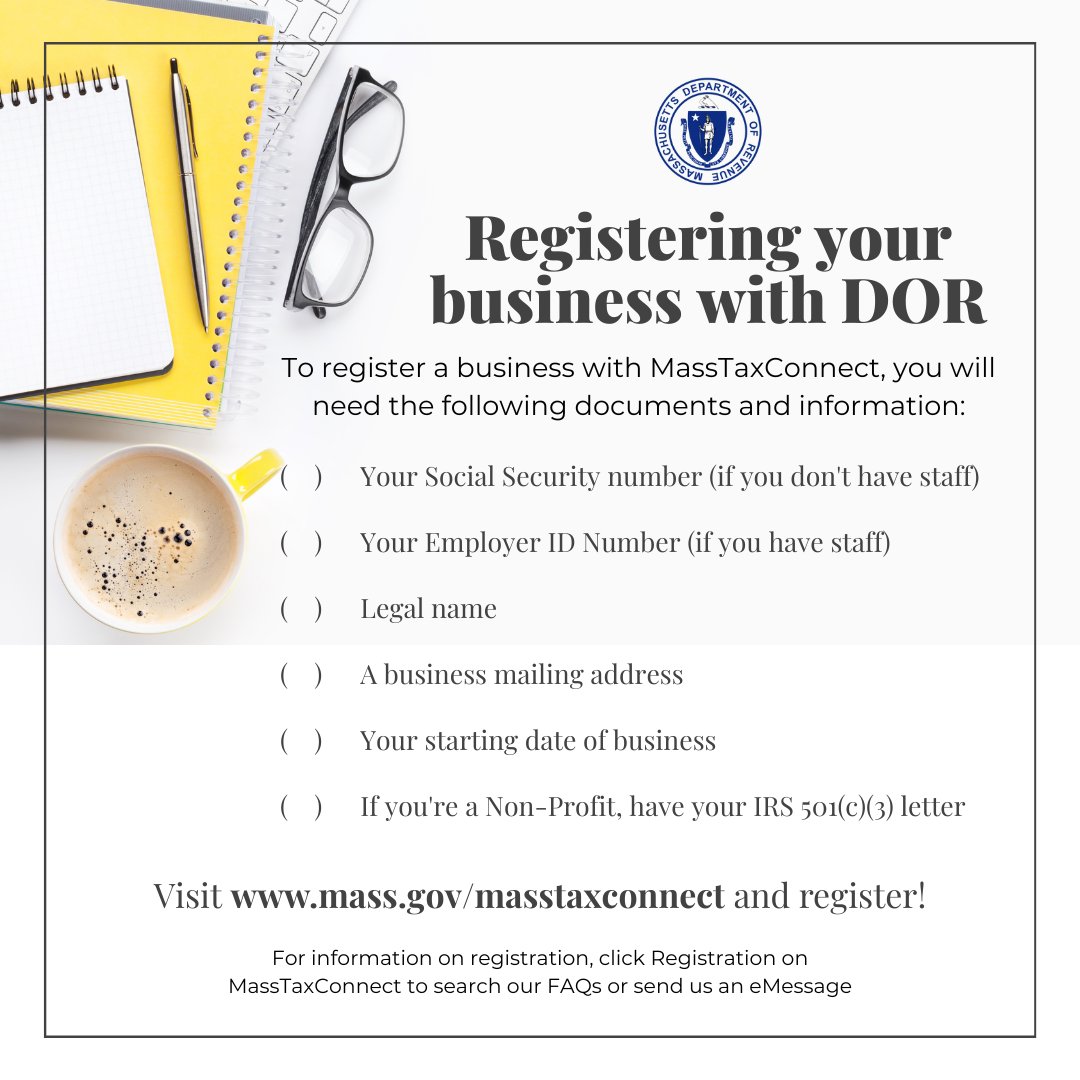

Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth. Make bill payments return payments estimated tax payments and extension payments from a bank account or using a credit card. Learn how to register your business with MassTaxConnect DORs web-based application for filing and paying taxes.

Select the Individual payment type radio button. Select the Manage My Profile hyperlink in the top right section of the Home panel. Payments in MassTaxConnect can be removed from the Submissions screen.

Select the Delete My Profile hyperlink in the Access section to cancel your current username. Individuals and fiduciaries can make estimated tax payments with MassTaxConnect. Please enable JavaScript to view the page content.

If you need a new username. From the MassTaxConnect homepage select the Make a Payment hyperlink in the Quick Links section. How to pay Massachusetts taxes.

There is a convenience fee of 235 of your payment amount charged by the third party that provides this service. To pay by period. Payments must have the status Submitted to be deleted.

Do more with MassTaxConnect. You can also learn how to apply for an Employee Identification Number EIN request a certificate of good standing or find out about the latest business tax credits. Visa MasterCard or Discover credit card or.

You can just go ahead and pay taxes without the need for registration. You may pay with your. With a MassTaxConnect account you can.

Your credit card for a fee or. See Tutorials and FAQs. In addition extension return and bill payments can also be made.

Individuals and businesses can make estimated tax payments electronically through MassTaxConnect. You can then reregister creating a new username to gain access to your tax accounts. MyconneCT is one part of a multi-year multi-phase information technology IT modernization initiative.

Please enable JavaScript to view the page content. Fiduciary tax payments can also be made on the website but an account with log in information is needed. Use this link to log into Mass Department of Revenues site.

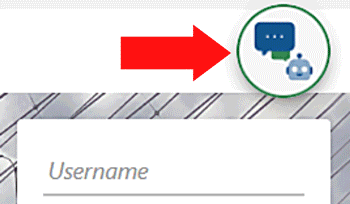

Your support ID is. This video tutorial gives you an overview of the MassTaxConnect system including how to set up an account andor log in. Enter the taxpayers name.

Tax payments can be made on MasstaxConnect with. Under Quick Links select Make a payment in yellow below. Open link httpsmtcdorstatemausmtc_ From this page click on the Make a Payment tab then youll be prompted to log in to your account.

Your support ID is. ACH debit from checking or savings account. Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth.

Its fast easy and secure. If you cant make your personal income tax payment in full pay as much as you can with your tax return. Below are some examples of where you can find payment options.

Access account information 24 hours a day 7 days a week. You arent required to sign up on Mass Tax Connect to pay taxes. The official search application of the Commonwealth of Massachusetts.

Search the Commonwealths web properties to more easily find the services and. From verifying a sales and use tax resale certificate to finding the latest. ONLINE MASS DOR TAX PAYMENT PROCESS.

You do no need an account. Massgov has a very user-friendly online resource called TaxConnect that provides information about your state taxes. You can only pay taxes.

Massachusetts Department Of Revenue Facebook

Massachusetts Dept Of Revenue Massrevenue Twitter

Massachusetts Income Tax H R Block

Massachusetts Sales Tax Small Business Guide Truic

Masstaxconnect Resources Mass Gov

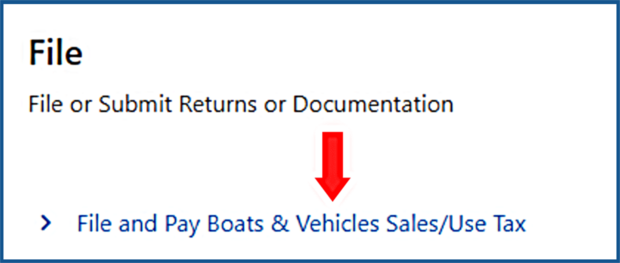

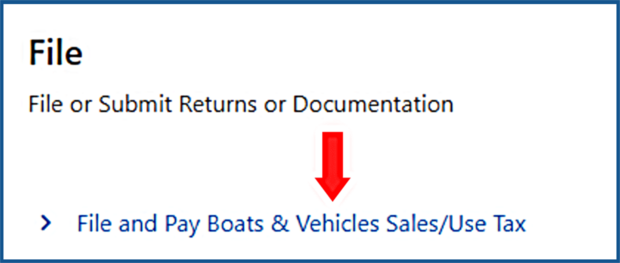

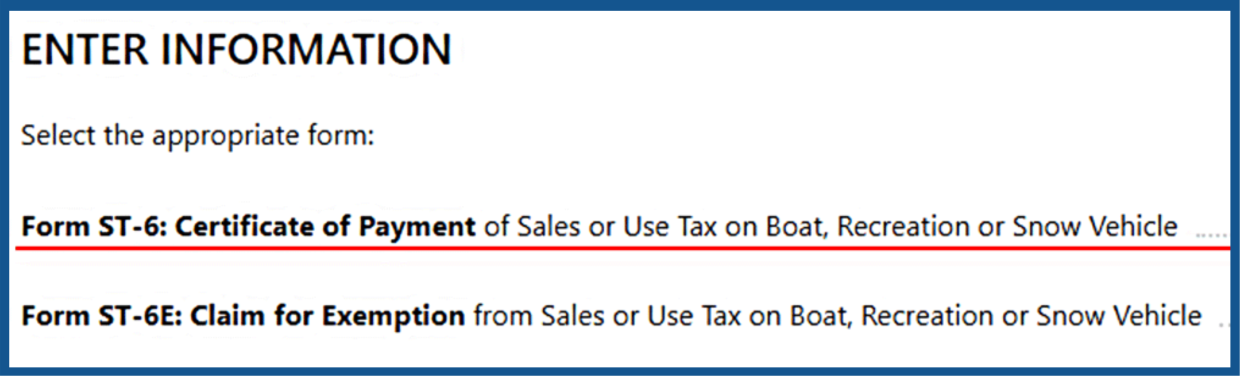

Sales And Use Tax On Boats Recreational Off Highway Vehicles And Snowmobiles Mass Gov

Form 1099 Instructions Office Of The Comptroller

Massachusetts Dept Of Revenue Massrevenue Twitter

Massachusetts Dept Of Revenue Massrevenue Twitter

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Massachusetts Department Of Revenue Linkedin

Sales And Use Tax On Boats Recreational Off Highway Vehicles And Snowmobiles Mass Gov

Massachusetts Dept Of Revenue Massrevenue Twitter

Masstaxconnect Resources Mass Gov

Prepare And E File Your 2021 2022 Ma Income Tax Return

Tax Guide For Pass Through Entities Mass Gov